7 Steps To Long-Lasting Stock Market Wealth

7 Steps To Long-Lasting Stock Market Wealth

Blog Article

Investing cash carefully is essential. Financial discipline and Expense control put money in your hands. But your profession is the greatest contributor of money. Profession Management and Wealth management go together. It is this which permits you to invest. So handling your career and growing it is without a doubt the most essential aspect if you intend on increasing your wealth. Again these are for individuals who are beginning their professions and from the point of view of long term wealth management. I am not touching on the nuances of HRM however putting down a couple of random thoughts for enhancing your career and life in general.The article is specific for readers from India though the majority of the concepts expressed are universal.

Now here's the important things, you would think that to do such a thing, you would require vast quantities of money - however that's not true. Not in the slightest bit. The market for the modest trader and financier has opened up of late. The essentials of wealth development is that you ought to constantly find channels for small financial investments that will provide you a great rate of return. For example, you might not be able to buy recently mined gold or diamonds or perhaps residential or commercial property for that matter, but you can put percentages in companies that do, and make an affordable rate of return. And you have actually simply gotten rid of a whole lot of threat from your portfolio.

To retire in 20 years with an earnings of $5000.00 monthly, you would need to accumulate about 1.7 million dollars. Assuming a rate of return of ten percent (a bit optimistic for shared funds nowadays), that would imply conserving about $1800.00 per month. Is that possible for many of us in today's economy? If you were only saving ten percent of your earnings, you would need to be making $216.000.00 annually. My previous jobs definitely did not pay that well.

No Load Structure: High commissions can have a harmful effect on even a great shared fund. Most fantastic funds use a no-load choice or a load-waived alternative that is available through financial advisors. These are the ones that you wish to invest in because every dollar goes right to work for you. not a broker.

Among the greatest fears of retired people is lacking money. Poor market only increase the fear. You need to spend time thoroughly thinking of what you'll have coming in during your retirement years as well as just how much you expect to spend.

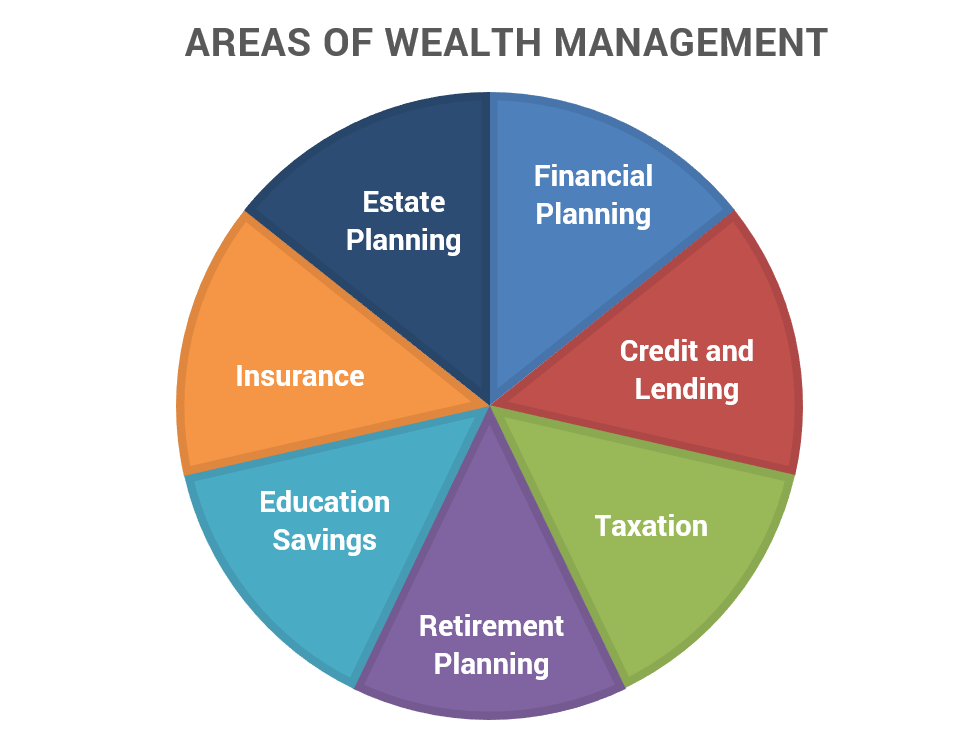

Having the ability to work your organization on the internet keeps it open to your busy schedule. Now more than ever it is essential for you to get adequate understanding to handle your investments effectively. Even if you do turn them over to another person to manage, you should stay an active gamer and in the understand. You need to be aware and comprehend what is happening with your wealth. An on-line service concentrating on wealth management is advantageous because it brings you the knowledge of maintaining and growing your wealth, it also has a neighborhood of like minded individuals who are prepared to support and direct you to your monetary objectives with you in turn helping them.

Once you determine your preferred yearly accumulation objective, it is time to get wealth management those dollars systematically positioned into your selected financial investments and let them begin building your wealth.

Develop wealth by becoming more innovative. Do this by thinking in pictures as much as you perform in words. By doing this you'll get that creative style buzzing. You can then apply this style to marketing, product style and creative methods of creating wealth.

Report this page